My Opinion | 126734 Views | Aug 14,2021

Mar 30 , 2025

By Wolfgang Fengler

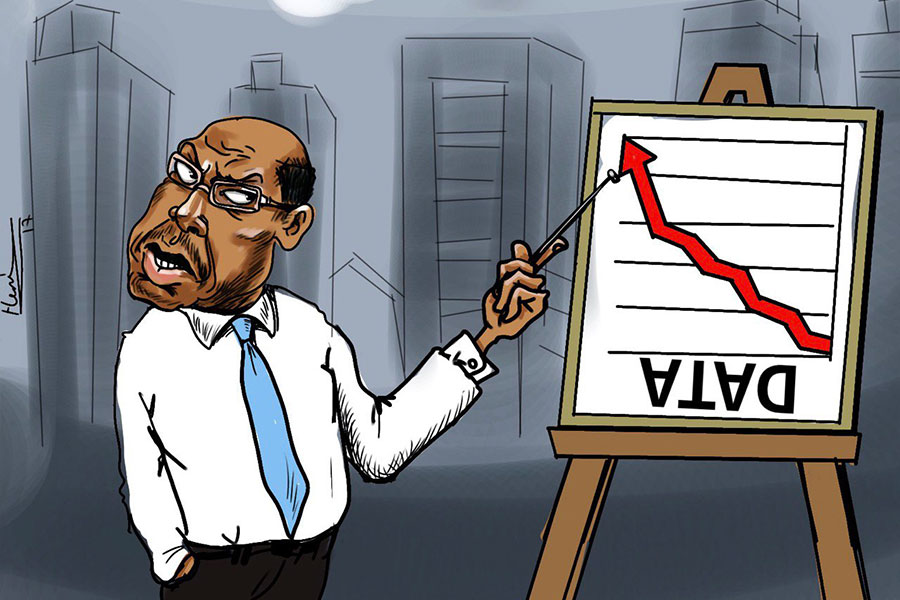

The monumental road toward eradicating extreme poverty has seen the numbers dwindle from 1.9 billion in 1990 to an estimated 615 million, due to rapid economic growth in Asia's most populous countries. Yet, much like the closing kilometers of a marathon, the path still requires perseverance. With global population growth now leaping forward in countries where poverty remains a formidable challenge, it's clear that economic growth alone isn't the universal solution, writes Wolfgang Fengler, a former lead economist at the World Bank, and CEO of World Data Lab, in this commentary provided by project Syndicate (PS).

At its most basic level, the goal of economic development is to eradicate poverty. By that metric, considerable progress has been made: the number of people living in extreme poverty fell from 1.9 billion in 1990 to an estimated 615 million today, largely owing to supercharged economic growth in the world's most populous countries in Asia.

But just as the last miles of a marathon are said to be the hardest, the progress made so far is insufficient to carry anti-poverty efforts across the finish line. Now that the fastest population growth is occurring in countries where poverty remains entrenched, and the globalisation engine is no longer as powerful as it once was, growth alone is unlikely to be enough. Escaping poverty is simply one step toward true prosperity.

We need alternative and complementary approaches to extend the ladder of opportunity to all and integrate the poor into dynamic economic activities.

Here, bolstering financial inclusion would help, because poverty is not only about how much a person earns. It is about what their earnings can buy them. Lowering the cost of goods and services, and thereby making them more accessible to those who have little, can thus reduce poverty. While advanced-economy governments often provide essential services, that is not the case in the Global South, where benefits are limited in scope.

In many Global South countries, essential goods and services are sometimes more expensive for the poor, and it is often costlier to reach this segment of society because they purchase only small quantities of products.

Financial firms have been particularly effective in overcoming these barriers. By lowering the costs of services and expanding access to them, they have demonstrated how inclusion can drive broader development. To explore the thresholds where individuals gain access to financial services, World Data Lab, supported by the Mastercard Centre for Inclusive Growth, combined its consumption models with the World Bank's Findex database.

Our research finds that increasing financial inclusion, which ranges from basic mobile money wallets to full-fledged banking services, disproportionately benefits the poor. We focused on the world's six billion adults – people aged 15 and older, who are more likely to be economically active – and split them into six buckets of one billion each, according to consumption level.

The poorest billion people, who spend less than five dollars a day, used to be excluded from financial services – their economic lives were built solely on cash payments. But over the last decade, a silent revolution in mobile money and digital payments has taken place, particularly in India and African countries. As a result, more than one-third of the world's poorest billion adults now have access to financial services.

These gains have been propelled by the interplay of the income-growth effect, whereby more people have crossed income thresholds that make them "bankable," and the price effect, whereby the cost of delivering financial services to the unbanked has fallen.

In 2015, around 3.4 billion people had access to financial services. Back then, the "price point" for entering the financial system (at 2017 purchasing power parity) was approximately eight dollars a day. That left two billion people – nearly 40pc of the world's adult population at the time – excluded. Over the last decade, economic growth has created a larger global middle class. At the same time, the cost threshold for accessing financial services has dropped substantially, owing to technological innovations such as mobile money and digital banking.

The combination of these two forces has enabled an additional 1.4 billion people – some 800 million from the income-growth effect, and another 600 million from the price effect – to gain access to financial services since 2015. The average global threshold for entering the financial system has dropped to five dollars a day. This lower entry barrier, reflecting the impact of digital money systems, has improved the inclusion of poor people.

Among the best-performing countries, especially in Africa, financial services can be offered at a price point of two dollars a day – below the extreme poverty line of 2.15 dollars.

The progress made over the past decade proves that financial inclusion can be achieved with the right mix of innovation, investment, and collaboration. Now, as we approach the last mile in the poverty battle, we should focus on bringing the most marginalised communities into the financial fold.

PUBLISHED ON

Mar 30, 2025 [ VOL

25 , NO

1300]

My Opinion | 126734 Views | Aug 14,2021

My Opinion | 122852 Views | Aug 21,2021

My Opinion | 121014 Views | Sep 10,2021

My Opinion | 118912 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Mar 30 , 2025

When the private satellite channel, Ethiopian Broadcasting Service (EBS), aired an em...

Mar 23 , 2025

Getachew Redda, head of the Tigray Interim Regional Administration (TIRA), at least u...

Mar 16 , 2025

Ask anyone about the population of Addis Abeba, and a straightforward answer proves e...

Mar 9 , 2025

Five years ago, 11 non-governmental organisations (NGOs), together with 40 allies acr...

Mar 30 , 2025

The brewing industry faces a storm, with barley shortages leading to a substantial sp...

Mar 30 , 2025 . By BEZAWIT HULUAGER

Federal officials are accelerating the shift towards domestically assembled electric...

Mar 30 , 2025 . By AKSAH ITALO

The federal government is pushing towards a single account for the treasury to consol...

Mar 30 , 2025 . By BEZAWIT HULUAGER

The Ministry of Transport & Logistics faced scrutiny after federal auditors uncov...